Math in the News: Are Mathematicians the Reason Why You're Broke?

As you may have heard, the economy is in a bit of trouble. People continue to debate the root cause of the current crisis: some blame so-called predatory lenders for pushing mortgages on people who couldn't afford them, some blame the borrowers themselves for recklessly taking on loans to try and live beyond their means. And of course, as with any problem, there are those who try to shift the blame to mathematicians.

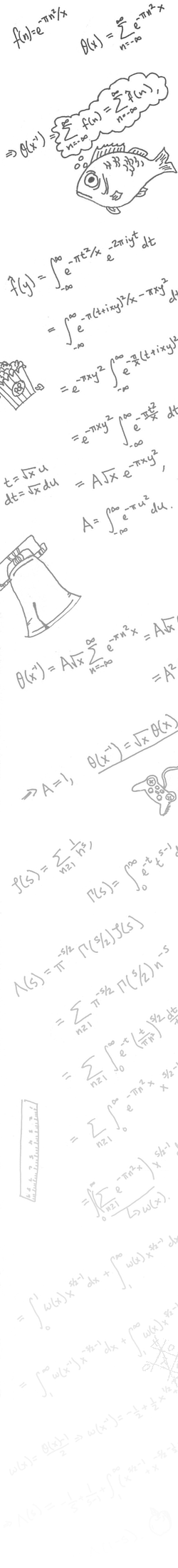

Why mathematicians? Proponents of this theory assert that our current financial collapse is the fault of the math whiz kids hired to work on Wall Street or manage hedge funds. It is no secret that investment banks have been hiring bright mathematical minds for years, then squeezing that brainpower into models for trading.

The use of mathematics in this case isn't the problem (indeed, when could using mathematics ever be a problem?). The problem, the critics cry, is that nobody understood the models that were developed - not the economists, not the credit ratings bureau, and certainly not your average Joe Sixpack. Nevertheless, the models worked, at least for a time, and made many people very rich. And so the models were used, without a complete understanding of how they worked, until everything began to go horribly wrong.

This general idea has found its way to most media outlets. Below is a story from 60 minutes that briefly touches upon the issue in an interview with former US Deputy Treasury Secretary Roger Altman. The BBC jumped on this bandwagon even earlier, with an article on "quants" (a.k.a. quantitative analysts, math junkies hired for finance jobs) that appeared nearly a year ago.

Jump to the 7:00 mark to learn how mathematicians RUINED YOUR LIFE!!!

It certainly is convenient to blame mathematicians for this crisis. The more pressing question, of course, is whether these assertions are merited.

I think not. After all, mathematicians never told investors to use their models irresponsibly. If the investors didn't understand what they were doing, they should have spoken up, or at least brushed up on their mathematics. Why would you gamble with billions of dollars if you didn't understand the game you were playing?

Some will argue that perhaps these mathematicians and physicists built their models on false assumptions, thereby creating simulations that were bound to fail. This is a weak copout at best. These people were hired by these institutions to model the markets, but in the end, the investors are the ones to pull the triggers. It is their responsibility to ensure that the models they are working rest on sound hypotheses, and it should go without saying that nobody should act on what the model is saying without understanding it.

What about the criticism from the BBC article mentioned above? In the article, a quant by the name of Paul Wilmott throws himself under the bus by explaining why he believes quants should share some of the blame for the economic downturn:

"The way in which quants are compensated encourages them to use the same strategies as everyone else."He claims that many quants calculate that if they lose money as a result of following a novel strategy they will be fired.

However, if they lose money as a result of following the same strategy as everyone else, they will not get the blame.

"The problem with this," says Mr Wilmott, "is that if something bad happens, it happens across the board."

If true, it's certainly the case that mathematicians could have been more forward. Perhaps they were too attached to the lavish lifestyle that a job in finance provided. Even still, it's difficult to imagine that a group of mathematicians could have actively built a culture that stifles creative problem solving. Certainly it's in the investors' best interests to not lose money, but any true mathematician should follow the data, rather than making data fit with expectations. Is it the fault of mathematicians that the culture of the industry was so resistant to the intuitive idea that you can't always make your investments pay off?

If mathematicians are to blame for the evaporation of your retirement savings, I have yet to find a compelling argument for why (unless of course, you were robbed by a mathematician, in which case I offer you my sympathies). This seems like just another case of passing the buck - we blame the passive mathematician because we know he won't fight back.

The moral here is one that will be familiar to anyone who has seen Harold and Kumar Go to White Castle. On the fateful night that Harold and Kumar set out on their pilgrimage to the aforementioned eatery, Harold had been screwed over by some of his coworkers, who talked him into staying late and finishing their work for them so that they could go out, party, and be generally irresponsible. The audience is led to believe that Harold has been doing their work for some time, but he never gets the credit.

During the course of the film, owing to some hijinx and a bit of tomfoolery, Harold loses all the work he has done, and when he serendipitously meets up with his coworkers later, they tell him that there will be hell to pay come Monday morning because of it.

It is at this point that we witness the transformative power of Harold's journey to White Castle. Whereas before he may have shied away from confrontation, in this climactic scene he confronts his aggressors with strength and confidence. He makes it clear that he will not allow them to walk all over him and blame him for their own shortcomings, then suggests that they both have gonohrrea.

While this last step may be a bit overboard, it certainly couldn't hurt for mathematicians to say a little something to stop investors for laying the blame on their shoulders. A little blame, maybe. But with so much to go around, there's no need to burden us unnecessarily.

Psst ... did you know I have a brand new website full of interactive stories? You can check it out here!

comments powered by Disqus